| Author | Message | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 1420 Registered: 4-2003 |

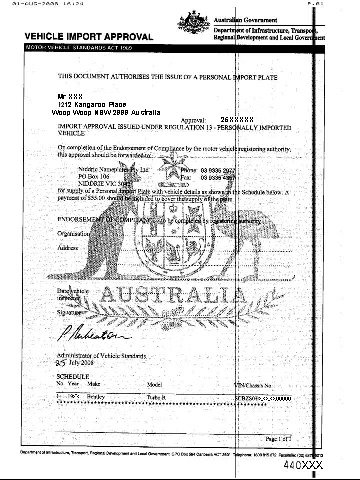

Import of Vehicles to Australia Having gone through this process recently, it may be useful for those contemplating the import of a vehicle to Australia, or the purchase of a vehicle imported to Australia when not new. This thread applies specifically to personal imports of vehicles built before January 1, 1989. Later vehicles are covered, but generally they need an Australian compliance certificate provided by the manufacturer when new. It may be fitted at a later stage, but only if the vehicle was built to comply with the ADR standards at the time of delivery and if the manufacturer is unusually obliging. Note that European Model Years start in September of the year before, so many 1989 model year cars were built in 1988 and are therefore eligible without Australian compliance. The subject is broadly covered under: http://www.infrastructure.gov.au/roads/safety/bulletin/importing_vehicles/index.aspx but a little clarification may be useful. Before contemplating the purchase of any Crewe vehicle at home or abroad, it is nigh essential to obtain its factory build sheets by emailing Barbara Westlatke at the RREC: The Records Archivist is Mrs Barbara Westlake, who can be contacted at: Email: barbarawestlake@rrec.org.uk Fax +44 (0)1327 811797. She often provides the important first few pages of the records as a generous gratis gesture by fax. If you know an RREC member, it may help if that member requests this service on your behalf. Personal Imports. The vehicle must have been owned and used continuously for at least 12 of the past 18 months in a foreign country. As a minimum, you will need a vehicle purchase contract, registration certificates with certified translations, proof of residence, a statement of travel and proof that you were not in Australia, and copies of your passport. Once the forms provided in the above link have been submitted along with the fee, you should receive a certificate looking like this:  The vehicle may then be imported, ready for the next phase. The vehicle must be presented, along with all papers, to your local registration authority in Australia. It will be inspected, and certain modifications may be necessary before the import certificate is endorsed before registration. This is not a compliance test as there is no such thing in this case. You will receive an endorsement of compliance, which exempts the vehicle from Australian compliance requirements. It does not exempt the vehicle from any basic safety or environmental requirements. Typical modifications are: New headlamps, sidelamps or lenses Rewiring of some electrical functions Electric windows master switch New or replacement headrests (typically many European imports have none or have ones not approved locally) Replacement windscreen wiper assemblies (non-reflective and so on) Compliant seat belts Replacement exhaust system Tyres less than 5 years old Replacement wheels Deletion of mascots and some badging Deletion of some brightwork and extruding items Catalytic converter retrofits and closed-loop emission systems are generally not required for vehicles built before January 1, 1989. Left hand drive is generally not allowed except with restrictions and only under certain special circumstances. Once endorsed by the local Australian registration authority, the importation certificate shall be forwarded to Niddrie Nameplates in Victoria, and for $55 a compliant exemption plate will be issued. The plate must be affixed to the vehicle permanently in an approved location. The vehicle will then be eligible for normal periodic vehicle inspections, and may be resold without restriction subject to some taxation caveats based on length of ownership. To spell it out, the vehicle will not be Australian compliant, but will be exempt from needing Australian compliance. Buying a Vehicle Already Imported. Buyer Beware. Don’t even consider buying a vehicle not sold new in Australia unless it has the compliance exemption plate affixed and papers provided, along with an official statement that it is not encumbered with any importation duties or tax liabilities upon resale. In the cases of diplomatic or consular vehicles, the seller must obtain the necessary plate and certificates from the authorities before sale. Fortunately, most such vehicles were delivered new in Australia, such as the string of British High Commission Silver Shadows, Silver Wraith IIs and Silver Spurs. However, personal imports by staff often need the exemption plate prior to resale, although it is usually automatic. This is absolutely essential; otherwise the vehicle may at best be sold as spare parts. Comments are most welcomed. RT. | ||

Mark Taxis New User Username: mark_taxis Post Number: 6 Registered: 4-2007 |

Richard is quite correct in his article, but be aware that the regulation for "compliance" varies from state to state. I imported a 1951 Mk6 special Before I could register the vehicle I had to obtain a LO2 plate. This involved going to an approved Engineer and getting him to inspect it, he only checked things like lights dipping the correct way etc, and as the vehicle was 1951 there were very few regulation that it had to comply with e.g Seat belts not required, but if fitted they have to comply with modern day standard. This means that the later the model car then the more items there are that have to be checked. At the end of the inspection a plate was fixed to the firewall. During general conversation with the engineer he told me that a car checked and passed in another state may not necessarily accepted in Queensland and visa versa, On the matter of importing, I imported the car under another method (I cannot remember the category) but basically I had not owned the car for 12 months. You still need the import cert from Canberra and a receipt. In my case there was no duty, but GST is applied to the final import cost ie, total of freight cost, quarantine cost, customs forms etc etc. I have also heard (but not confirmed) that if the car is worth more than the luxury car threshold then the luxury car tax can be applied Rgds Mark | ||

Craig Knight New User Username: grum_ck Post Number: 3 Registered: 9-2007 |

I have just booked shipping for my 1997 Turbo R after gaining approval to import it under the personal import ruling (I have owned the car and lived in the UK for the last 12 months which qualifies me for this). As far as compliance goes, I believe I need to get child restraint anchorage points and possibly fuel filler restrictor modifications but not much more… I’m planning to send it to Stensanc to get this done and compliance completed. Apart from that it’s just the taxes and duties to pay, hopefully it all goes smoothly. Wish me luck, Craig | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 1486 Registered: 4-2003 |

As a clarification of what Craig has already done, here is a summary for the unaware. Craig, please let us know how you get on once the car is registered in Australia. <<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<< Please, be absolutely sure about all the following by written authority from Australian Customs. It all applies to all cars, including personal imports. Be sure BEFORE you apply for the Australian Vehicle Import Approval VIA import certificate, that the vehicle is elegible. You must have the VIA certificate or the car may be shipped and arrive, but will be impounded and probably scrapped on arrival by Australian Customs or sent back to the port of origin at an inflated shipping cost paid in advance. It cannot be overemphasised that you need a Letter of Compliance from Crewe for January 1 1989 cars onwards, and the VIA from Australian Customs for all cars regardless of age. If the car was built after January 1, 1989, the rules are very strict as follows, and even passing the criteria and having a VIA does not give you the right to register it in any state or territory. A shipping agent abroad loves to fill containers at the owner’s risk. They may promise that all is OK, but they usually do not really know. Only VIA certificates from Australian Customs are valid. I know of someone who tried to send a car to NZ first, but that didn’t help for OZ. If the car was built after January 1, 1989, to do this, you will need the Letter of Compliance from Bentley Motors Limited in Crewe. They will probably need to inspect the car at Crewe, and Bentley is certainly not be interested in giving one. They are even very unlikely even to be able to issue such a letter if the car was not originally built to Australian compliance, whether the car has since been modified to the required standards or not. No dealer, agent or franchisee abroad or in Australia can issue this letter. No Australian organisation or authority is legally able to do this under any circumstances. The only other possibility for 1989+ cars is to seek an explicit Exemption for Exceptional Circumstances Certificate from Australian Customs before it arrives. The exemptions are almost always rejected except for prototypes and vehicles never to be driven on public roads, so beware. Quote: 4. Letter of Compliance - Part 9 on Application Form Dealers and distributors do not have authority to sign a Letter of Compliance. A Letter will only be issued by the manufacturer where a vehicle was originally built to Australian specifications (ie to comply with the Australian Design Rules). A Letter of Compliance states that a vehicle complies with the applicable ADRs at the time of the vehicle's original build date. Only the authorised Australian representative of the manufacturer, or the organisation holding the Plate Approval for the particular vehicle model, can issue a Letter of Compliance for the vehicle you intend to import. It is therefore only in exceptional circumstances that a Letter of Compliance can be obtained. Unquote For all cars less than 30 years old, when the car arrives, the Australian charges af follows: Take the purchased price of the vehicle (not reduced even if the vehicle has been owned abroad for many years) PLUS shipping costs PLUS $1,000 handling and quarantine fees PLUS $500 steam cleaning. Add 10% GST (VAT) on that amount. Then add $200 to upgrade the refrigeration. Finally add a further 10% duty (absolute minimum for a personal import and maybe 25% for 1989+ cars), or even more than 25% if the car does not qualify, of the whole sum above. If the final sum is more than $57,130, a 25% additional special tax applies to the difference. Note again that the vehicle purchase price CANNOT be depreciated for length of ownership unless a local valuer in Australia can certify a lower value in Australia. To reduce this, find a dodgy dealer abroad at your own risk, who will technically buy the car from you and sell it back at a reduced price for a nominal fee. Cars over 30 years old only pay the GST and no customs duty. I don’t wish to discourage anyone, but a late surprise would be devastating, and Australian Customs are not at all flexible in this regard. RT. (Message edited by Richard Treacy on 17 October 2008) (Message edited by Richard Treacy on 17 October 2008) | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 1487 Registered: 4-2003 |

ps: My Turbo R is a personal import. Last week it was valued for the above at the price I paid years ago in the UK including GST/VAT, plus Swiss GST on that, as the purchase price, and no depreciation was allowed on that sum. Clearly, to avoid all the trouble and to reduce costs, best is to buy a late 1988 car just over a year before shipping to qualify it as a personal import and without needing a letter of compliance from Crewe. At least then, the purchase price will have been reduced to the market value abroad, probably being next to nothing by then. Remember, secondhand imports have an Australian market value of about half that of locally-delivered cars for anything less than 35 years old. RT. | ||

Craig Knight New User Username: grum_ck Post Number: 4 Registered: 9-2007 |

Hi Richard, thanks for the detailed post. I’m nervous about questioning your wealth of knowledge on anything car related… but my understanding is that you need a letter of Compliance OR meet the personal imports criteria (basically lived, owned and used the car in a foreign country). I have received the Australian Vehicle Import Approval, 4 copies titled: “THIS DOCUMENT IS FOR CUSTOMS CLEARANCE” "THIS DOCUMENT AUTHORISES THE ISSUE OF A PERSONAL IMPORT PLATE" "REGISTERING AUTHORITY'S DOCUMENT" "OWNERS DOCUMENT TO REMAIN WITH THE VEHICLE" Hopefully this will allow me to register the car in Australia (once I meet the Victorian safety/RWC requirements). I have been led to believe that the 97 model complies with many of the required safety requirements, but will need a few things like child restraint anchorage points and fuel filler restrictor modifications. They have also increased the luxury car tax to 33% on any value over $57180. Plus I believe you can have your ‘landed’ car valued (at your cost) and base the tax/duty calculations on that… this may be useful if you have owned the car for a long time and the value has depreciated significantly. I will find out how correct my understanding is in the near future, and I’ll let you know how it all goes. Cheers, Craig. | ||

Bill Coburn Moderator Username: bill_coburn Post Number: 1020 Registered: 4-2003 |

Somewhere in the memory banks I seem to recall the fuel filler bit being scrapped since there aint no more of the stuff to 'illegally' put in your tank. As to the saftey requirements etc the Road Traffic Authorities have bred almost a cult in their pursuit of the compliant vehicle. Years ago (here we go again) a '76 Shadow came in from the ole'dart to Canberra where we had a platoon of officials who would put Gilbert and Sullivan to shame. The car went in for the final inspection before registration and they went over the car like a swarm of formicating ants! Seemingly crest fallen at finding the car met all the criteria, one triumphant inspector spotted the mirror in the sun visor, tapped it and pronounced 'FAIL' in a satisfied voice. You see it was glass! I think the requirement was polished stainless although perhaps by now toughened glass may be acceptable! The owner, a man not known for his placidity eyed the inspector with unveiled malevolance while plucking up a large adjustable shifting spanner from one of the inspectors benches. He advanced on the car with unclear purpose, the hapless inspector retreated hastily, the owner flung open the door on this admittedly pristine car, flipped down the sun visor and proceeded to smash the mirror. 'There' he announced and flung the spanner to the ground in a very effective dramatic gesture. The car passed! | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 1488 Registered: 4-2003 |

Hello Craig, I have already had my car valued as you suggest. I am still awaiting a reduced GST and duty invoice, as the last includes all the above charges in full based on the full UK price and Swiss GST I paid way back. Even so, it already allows for my full rights and exemptions for the car to be a personal import. For a realistic valuation, the firm: Hills Assessing West Ryde Pty Ltd (02) 9809 7155 +61 2 9809 7155 1 Maxim St West Ryde NSW 2114 is very good, and take into account the greatly reduced value of a secondhand import. They only charged me $150. They have associates in all states. I am anxiously awaiting the final invoice from the tax and customs people. I also have a good local handling agent if you do not have one yeat as you will nedd one. They charge separately, but their charges are added to the basic purchase price for tax and duty purposes. They can also arrange the steam cleaning which you will need. I hope that you are correct about the exemption on the LoC for personal imports, as it is contrary to the leaflet and to verbal information I obtained when in Canberra in August this year. I was told and read that the only benefit of a personal import is a reduced duty. Before you actually ship the car, I strongly recommend that you obtain a formal letter from the Queensland (?) traffic authorities abd customs. I have lived abroad continuously for 16 years this time, and have owned the car here for many years now. RT. | ||

John Smith Unregistered guest Posted From: 150.101.158.217 |

Hello forum members Is it possible to import a LHD Turbo-R into Victoria for personal use? The car is a 1990 model, assembled in late 1989. I've read through all of the customs and DOTARS documents and it would appear that it is not possible under the current regulations. Could anybody confirm that this is in fact the case? Thank-you in advance for your assistance. (Message approved by david_gore) | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 1519 Registered: 4-2003 |

I really don't like your chances overall, as the rules are very clear. LHD can, at best, be registered for very restricted use, and probably limited to some months. In times gone by, only the ACT would allow normal registration for LHD cars, and then only if imported by diplomats (you know, yanks sleep with beloved Chevs) or subsequently sold in the ACT to a new owner. The ten foot high LEFT HAND DRIVE red notice on the back was always an in-your-face requirement. However, rules are sometimes flexible, so only VicRoads will confirm or otherwise on a case-by-case basis. Even then, it may be illegal to drive interstate, and the car may not necessarily be deemed fit for registration in all states. Despite the text in the rules to the contrary, recently reported cases indicate that Customs seem pretty OK with just about anything if you cough up enough cash, but registration is the acid test. Third party insurance may be very difficult to find if at all, and finding comprehensive insurance has Buckley's chance. Resale in Oz will be zilch, so all round it will be an expensive exercise even if it is possible. However, the novelty of having the wheel on the left to show off may be the prize. It beats bling I guess. RT. | ||

John Smith Unregistered guest Posted From: 150.101.158.217 |

Hi Richard Thanks for the response. It looks like I cannot get it into Victoria (I haven't checked the requirements for the other states) From what I can see, the main problem will be that VicRoads will not register LHD vehicles for personal use that are less than 30 years old, unless they're on a club permit (which drops the age limit down to 25 years or older). The only exceptions are for specialist vehicles or market evaluation samples. There's a good summary in the following VicRoads PDF file. http://www.vicroads.vic.gov.au/NR/rdonlyres/EFD263AC-A239-46CB-93CF-1D620B6CCA48/0/VSI18.pdf (Message approved by david_gore) | ||

Brian Carson New User Username: brian_carson Post Number: 3 Registered: 7-2009 |

Does anyone have a round figure to transport a car from the UK? Having viewed many Rolls Royce motor cars for sale online (and its by no means a conclusive way to asess a vehicle I know), but it appears to me that they are almost giving some away...caution of course, but its tempting. | ||

Craig Knight Experienced User Username: grum_ck Post Number: 14 Registered: 9-2007 |

Hi Brian, here is a list of costs that I had importing my car back. It was done as a personal import (as stated above). These can vary depending on time of year (there are peak shipping times). Ocean freight: EUR1010.00 (incl BAFand OTHC) Origin Ex-Works: GBP458.50 Destination Charges: $1139.50 + GST (see break below) Port Charges: $546.00 Customs Clearance: $125.00 Quarantine: $68.50 Sea Cargo Automation: $25.00 CMR: $10.00 Collection of container and unpack for inspection: $365.00 (does not include the inspection). Plus additional fees from Australian Customs and Quarantine, but generally if the car is clean and AQIS do not have any issues there should only be an inspection fee on the above. Transportation fees which will depend on how far the car has to be taken for compliance. Then you have all the taxes as stated above. Then the cost of any compliance work and the compliance certificate. This cost me around $1800 Then stamp duty - 4% of the final value in Victoria (basically add up all the costs above) and registration. Cars are much cheaper in the UK, but I think the Australian government have set their taxes and fees to a level that makes it difficult to make money importing vehicles. But you do get a larger selection of cars there, so if you found a great example it may be worth doing for personal use. Good luck. | ||

Brian Carson New User Username: brian_carson Post Number: 4 Registered: 7-2009 |

Much appreciated Craig. I have by no means made my mind up but if I go back in the next couple of years it may be a good excuse to go and see a few that are for sale. | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 2022 Registered: 4-2003 |

Well, my car cost about $11,000 from Zurich to canberra last year, plus 10% of the vehicle value plus shipping as import duty plas another 10% on that sum for GST. That included $500 quarantine, and also clearances etc. The actual shipping cost is negligible in itself, but the costs add up. A 12 foot container for housdehold goods costs around A$12,000 plus plus from London to Sydney door_to_door by comparison. I booked it in Australia as even that was cheaper than shipping from Europe. About $1000 of that was for the trip from Zurich to Hamburg, the cheapest port.In any case, another $200 to Canberra. Count on A$20,000 all in including taxes and duties and you won't have much change. RHT. | ||

Richard Treacy Grand Master Username: richard_treacy Post Number: 2024 Registered: 4-2003 |

That's all for a personal import. Add another A$1,000 afterwards for complaint child restraints and $80 for a compliance exemption plate as a personal import owned for some years. Most custons authorities, especially Port Botany, insist on that $500 steam clean no matter how clean the car is, so count on some significant steam damage and lost rocker cover finish at least. Next there is the rust, especially that which comes from a salty and humid tropical voyage. Then the electrics are corroded and need cleaning, or worse in the case of aircon and seat ECUs. The 4% stamp duty is irrelevant as it must be paid on all changes of ownership in Australia. It makes no sense financially to ship a personal import unless the vehicle has sentimental value or is unique. That rules out all standard_bodied postwar cars, especially SY and SZ cars. ps in the post above, I was of course referring to a 20 foot container, long enough for one of our cars. RHT. | ||

Brian Carson New User Username: brian_carson Post Number: 5 Registered: 7-2009 |

All food for thought Richard. Thank you. I dont think my car will be a particularly rare one or have any sentimental value so it may be hard to justify. Shame Australia cant be part of the EU. | ||

Nigel Johnson Experienced User Username: nigel_johnson Post Number: 22 Registered: 12-2008 |

Brian, be carefull what you wish for. Regards, Nigel. | ||

Brian Carson New User Username: brian_carson Post Number: 6 Registered: 7-2009 |

Yes Nigel...I know what you mean. I would never get a car if it could not be properly surveyed and I was there to get the "feel" factor right. There is a good selection of cars in Australia so that will probably be my prefered market. |